Our Story

Marketmaker Software Ltd was the operator of live sports bet trading exchange Oddsfutures.

Marketmaker was the the first to file and invent and recieve patents for novel Cash Out betting (by 4 years) in 2007. The product was in 2011 launched unlicensed by Betfair (NYSE: FLUT), when they duplicitously claimed its invention. Our first software development started in Dublin, Ireland in 2006 and our now granted US patents on Cash Out functionality (‘721, ‘157) and Exchange SP functionality (‘205) were published Q1 2007.

The claims in our 2007 filed intellectual property covered novel aspects of online wagering systems, including:

1. Systems and a GUI with computer readable instructions to enable processor execution of wager-related Cash Out activities, only possible in the realm of computer networks and continuously updated.

2. Input device varieties such as wagering stations and mobile devices.

3. Award determination based on outcomes and participant eligibility.

4. Award types including monetary, non-monetary, and various forms of property.

5. Award calculations based on factors like calculated probability and participant-originated wagers.

6. Participant options post-wager like termination of participation, continuation, or generating a new wager.

7. Options to transfer or sell wager entitlements or rights.

Our claims outline configurable systems for managing and executing wagering events with various participant and award options and have a 2007 priority date.

In 2006 Marketmaker recognized horse racing and online betting markets needed to create new pre game and in play betting inventory. Taking betting beyond binaries, Marketmaker developed new products using novel UX’s and multibet (parlay) settlment technologies and filing accompanying Irish & US patents in 2007. The company’s vision was to combine two new sports betting user experiences that put emphasis on user retention through engagement, in-play bet divestment and user re-activation.

Marketmaker had a long term vision and its founders a belief; that two distinct sportsbet product innovations, if combined and served to customers during dymanic odds changes would transform sports betting customer interaction and the entire industry user experience by allowing bettors avoid the outcomes of their bets.

Marketmaker’s 2006/2007 vision was to create and combine two at the time entirely novel sports betting features; a single button offered to the user to divest and Cash Out an existing bet (‘721,’157) served and priced in real-time by an uninterrupted dynamic probability re-pricing cycle of steps for each on field event in the betting UX. Much of this novelty built on our additional invention of automated exchange settlement prices, our (‘205) in horse racing.

Marketmaker US patented our two main functional and technical innovations in 2007. Marketmaker was the the first to file and invent Cash Out betting by 4 years. We then further attempted to partner and licence the products to the major UK operators by holding investment and liquidity based horse racing product development discussions with Betfair (now Fanduel/Flutter Entertainment) and other operators, from Q1 2007 to 2013

The b2b software licensing route proved fruitless, despite commercialisation and investment discussions with Betfair and several other UK operators.

36 months after our initial NDA was signed with Betfair product development/Ventures, and by 2010, we had built and launched horse racing only markets on our Oddsfutures.com betting exchange. We incorporated our novel Cash Out bet divestment product (‘721, ‘157) to USA customers for Cash Out in late 2011, whilst using Exchange Settlement Prices (‘205) for underwriting onsite liquidity from our 2010 USA & EU launch date for horseracing markets.

Subsequent to our 2007 NDA discussions on investment, IP commercialisation and potential licensing with Fanduel precursor Betfair; our ‘205 patented technology was introduced by Betfair, without licence, 11 months later in early 2008, and our single button Cash Out UX (our ‘721,’157) was launched by Betfair in Q2 2011, with Marketmaker launching the Cash Out product for holders of existing bets in Q3 2011.

True to Marketmaker’s vision, and investment thesis, the ‘205 exchange settlement price product was a godsend for Betfair’s early lay liquidity. The ‘205 feature Marketmaker had proposed for b2b licence was launched and then lauded by Betfair founder Andrew Black as a ‘tough mathematical and logical challenge’, ‘the biggest single add on to the exchange since it launched’ with the ‘scope to become an important product and the foundation stone for a variety of advances (cash out) down the line’.

Mid 2011, Betfair by then a public company also launched its single-button bet divestment Cash Out product. At the same time, Betfair claimed duplicitously that Cash Out was its ‘Invention’ on its corporate share marketing website; in press statements, financial literature and subsequent annual reports. A number of operators including bet365 and William Hill by 2013 had replicated the Cash Out UX product in their sportsbook apps, without directly integrating the ‘205 to underwrite it. Betfair during this period was also implicated in federal wire fraud cases in tennis trading, as well as paying, while a listed company, illegal dividends to its founders and shareholders (including some of whom Marketmaker had been negociating licencing with in 2007) of over £60m.

Using our own capital and applying our IP and innovations, Oddsfutures launched horse racing markets in partnership with PA Sport track feeds in 2010. By 2012 Oddsfutures had also added extensive sports betting markets, despite a refusal by the operators and exchanges to licence Oddsfutures standard commercial API trading access or paid access to market odds data.

Switch forward to today, the Cash Out feature in play is sportsbetting’s biggest user activation feature and the key UX driver of global in play sports betting liquidity.

In fact, if Cash Out were an individual sport, it would be the 4th largest sport in the world in betting volume terms.

-

Offering a ‘Get me Out’ UX button so users can divest and ‘Cash Out’ an existing bet to profit from odds prices.

-

Offering an ’exchange SP’ UX mechanism to lock in a bet settlement exit price at an agreed point in the future.

US patented in 2007, both innovations were offered by 2010 on our oddsfutures exchange before the exchange was closed in 2013 due to competitive factors.

Marketmaker’s Intellectual Property (IP) is now cited over 21 times as prior art IP by multiple b2b & b2c sports betting suppliers and operators including Winview Inc, Colossus Bets, Bspot, Game Play Network Inc, Diogenes, Air Play Network, and from the financial software sector by Wall Street software provider Trading Technologies International Inc.

Today

Marketmaker offers proprietary real-time in play prop bet pricing technology and consulting expertise. Marketmaker supplies proprietary quant driven models as well as our USA licensed Cash Out and Exchange SP intellectual property.

Today, our licencing offering for operators and software vendors combines enterprise tax efficient R&D bundled with live price data. A typical Marketmaker solution is delivered under a contracted research collaboration partnership.

Our licences solve the problem of a lack of sports betting inventory when the digital marketplace is betting one way.

A contracted research collaboration partnership with us can be harnessed to contribute positively to group EBITDA. This is done through corporate tax planning and the identification of individually qualifying Cash Out products and income across group activity regardless of regulated jurisdiction i.e. the tax deductible treatment of the IP license can also cover global Cash Out income and expenditure.

Legal use of our IP add’s longevity to US based consumer LCV by creating, simplifying and transforming the user experience.

Graphical User Interface for Cash Settled Bet Divestment in Odds Based Markets

United States Patent 10,713,721 B2

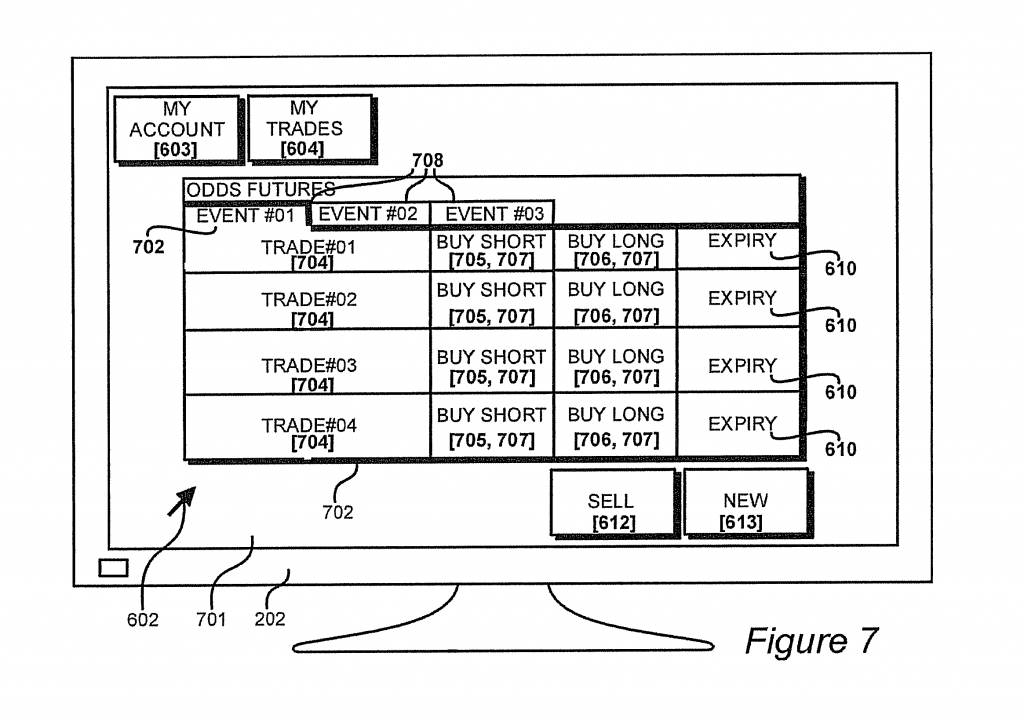

Systems, methods, and devices, are disclosed in which a graphical user interface is presented. The graphical user interface includes a first interface that displays a plurality of odds selection buttons for making a selection of one or a plurality of time-varying odds offered for trade on one or more outcomes in a betting marketplace and a buy button for communicating the odds selection over a network interface for matching as a bet. The graphical user interface further includes a second interface that displays at least one bet selection button for making a selection of one or more previously matched bets and a sell button for communicating the bet selection over the network interface for divestment of the selected bet. The second interface can be reached directly from the first interface via a single action of a user input device.

United States Patent No: US 10,115,157 (PDF)

If you want to do a 5 minute review to understand how Marketmaker’s granted US patents and IP can be harnessed in a research collaboration with your enterprise the tools are set out below.

On the webpage link above search using “control “F” helpful search terms include: ‘option’ ‘a bet‘ ‘divestment‘ ‘button’ ‘612‘ or ‘single action of the user.

Cash Out user interaction is delivered with button number 612 (depicted in diagram no 7).

This is the optional bet divestment button for the operator to sell a new divestment bet and the user to optionally click on it in a ‘single action of the user’ in order to ‘avoid exposure to the outcome of the event’

United States Patent No: US 8,510,205 (PDF)

This UX creates exchange SP’s as would typically be utilised in horse racing markets on a betting exchange.

This is done in order to guarantee or lock in an obligation (rather than present an option) to settle a bet prior to the outcome in a simpler manner that facilities a more efficient betting product.

The user interface solves the problem of exposure to the outcome of the sporting event and at the same time creates online inventory for each offered betting selection for a given sports event where none was previously available or the user could not be sure to lock in their profits.